How Price Disparity among E-Tailers is Fueling Online Arbitrage?

- by eSellerHub

Walmart is among those rare retail brands that have a dominating retail presence, online and offline. On the surface, Walmart is an epitome of a traditional chain of retail stores replicating its success in the electronic retail space. In reality, this is seldom a case.

Take Amazon, for example, while nobody comes close to the ecommerce behemoth in terms of user or brand power, it has zero presence in the offline space. When was the last time you saw an amazon store? They don’t exist.

There may be a few stores but you get what I imply here.

Buying Patterns and Trustworthiness

Amazon and Walmart target a different set of audience. Amazon targets millennials who don’t like stepping out to buy things and prefer to order them online. Walmart.com works as an extension of its store operations. It tries to replicate the same product portfolio to its online buyer.

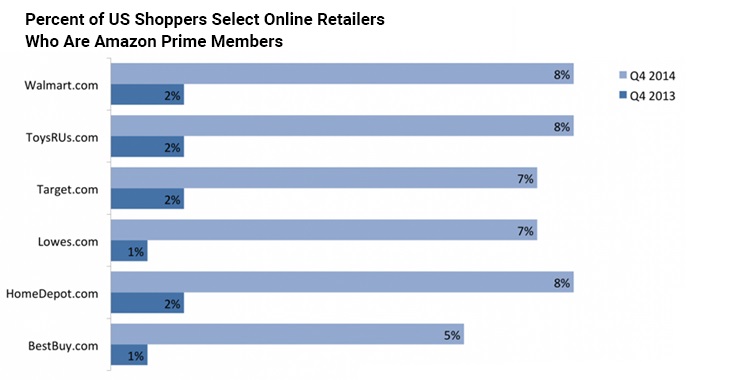

If we look at the graph above, Walmart is the top alternative to Amazon Prime customers and, thus, a great destination for online arbitragers to leverage on the price disparity between the two giant retail behemoths. Other options to Amazon Prime customers are Target and Home Depot with EBay not making it to the list.

In a way, every ecommerce website target a specific set of audience. EBay users are more after bargains and don’t mind buying used products. Ali Express is all about buying cheap Chinese goods.

However, a person who buys at Amazon may not trust Ali Express. A Walmart frequenter may feel alienated at Amazon’s offerings. EBay users will find Amazon costly. Therefore, at the end of the day, it comes down to individual preferences. In addition, people tend to install only one ecommerce store on their smartphones.

Sellers Can Leverage On the Disparity

You’re an Amazon seller. One fine day, an Amazon customer orders an item from your store, which you can’t fulfill. Therefore, you source the item from another seller. Let’s say a seller on Walmart this time. By finding a seller on time, you not only deliver the item on time but also make a couple of dollars and the idea struck you.

Online arbitrage isn’t a new concept entirely. In fact, it’s been happening since the early days of ecommerce. Lately, it has garnered an immense popularity as it enables sellers to run online store without owning a single piece of inventory. They leverage on price disparity of a product between two or more ecommerce stores—Amazon and Walmart in this example.

Online Arbitrage in Real Life

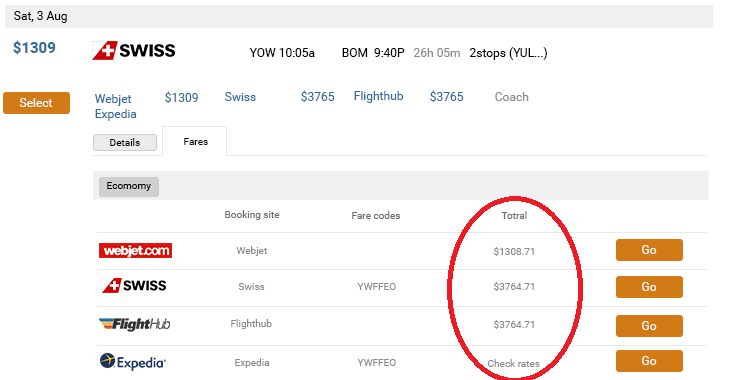

Last year, I saw a movie called ‘It’. While it was a children’s movie, I really like the theme the way they demonstrated evil and good in the movie. When I learned It is based on a novel of the same name by Stephen King, I wanted to buy it. I opened Amazon and typed ‘It’. The book was available for $13.09.

I acted smart. I did not order the very moment; rather I checked out its pricing on other websites. To my surprise, a few websites were selling it for less than $10. One listed of King’s supernatural horror novel for $8.

I can make a couple of dollars in cross selling. Therefore, I created a duplicate listing on Amazon and start selling Stephen’s masterpiece for $12. By the end of the year, I was a full-time online arbitrator, earning in excess of $10000 every year.

It’s Difficult Than You Think

While online arbitrage is not very different from cross selling between online marketplaces, it is tougher than it looks like. Delivering 10-20 books is quite different from delivering hundreds of diverse products every day. For a large-scale online arbitrage, you need a proper setup with ample staff, right software, and equipment.

You need to hire a team to identify the products different ecommerce websites for cross selling. Then you need someone to manage you so many seller’s account on different e-retailers’ websites. Then you need a software to keep track of everything. In the end, a large-scale online arbitrage is a demanding business.

Did I tell you? Online arbitrage is the business of volume. You can’t make a living by cross selling a couple of products every now and then unless you’re damn lucky.

Automate Your Business with eSellerHub

To manage a large-scale online arbitrage operation, you need a software solution to a manage it. For example, eSellerHub provides an end-to-end solution to manage online arbitrage. The solution automates you entire online business. You just have to run the initial setup, wherein you set some rules regarding price range, product, shipping time, seller’s reputation, profit margin for cross-selling etc.

Once the rules have been established, the solution will identify the products according to the rules, create a similar listing on the website you want to cross-sell on, of course, after adding the margin and wait for a customer to order. After a customer has made payment to order the product, the software itself orders the product to the customer’s address after after-deducting the payment.

The software gives you complete freedom from redundant work and automates most of the part of an online arbitrage. You no more need to hire additional staff or specialized equipment to manage warehouse since the operations goes from one e-retailer to another.

Boost Business with Analytics and Reporting

That’s not it for our online arbitrage solution. With our efficient reporting and analytics, you gain necessary business intelligence to boost your business prospects. With tabulated data, you can learn which strategies worked for you, which did not. You can also learn which product made you maximum money, which brought maximum buyers or gathered reach.

From the intelligence gained, tweak your software to maximize returns. Do that a few more times and soon your online arbitrage will be in autopilot. First, the software learns from you; then you from it. I have seen many online sellers making informed decisions based on the data they collected. In fact, you can also take calculated risk on the back of the gathered data. As they say, data is the new oil.