For many UK retailers, managing an ever-growing product catalogue can quietly erode profitability. Slow-moving SKUs do more than take up warehouse space. They increase storage costs, tie up working capital, and make demand forecasting less reliable.

As multi-channel selling becomes standard practice, tracking SKU performance across platforms such as Amazon and eBay, alongside direct-to-consumer stores, adds another layer of complexity. SKU rationalisation provides a structured way to reduce catalogue clutter and focus on high-margin, high-performing products. In this guide, we explore the SKU rationalisation process, its key benefits, and best practices for UK retailers looking to strengthen inventory control and long-term profitability.

What is SKU Rationalisation?

SKU rationalisation is the strategic process of auditing your product catalogue to identify which items genuinely contribute to your bottom line. Rather than simply cutting products, retailers use performance data to decide whether to retain, improve, bundle, or discontinue specific items.

A SKU, or stock keeping unit, represents a unique product variation such as size, colour, or style. As retailers expand their range, catalogues can quickly become bloated with variations that generate limited demand. Without regular review, this often results in:

- Duplicated listings across marketplaces

- Capital tied up in slow-moving stock

- Higher storage and handling costs

- Operational inefficiencies in fulfilment

UK SKU rationalisation strategies are based on data-driven evaluation. By analysing sales velocity, gross margins, and inventory turnover, retailers ensure that every product justifies its shelf space, both physical and digital. The objective is not to reduce choice arbitrarily, but to create a leaner, more profitable assortment that is easier to manage across multiple channels.

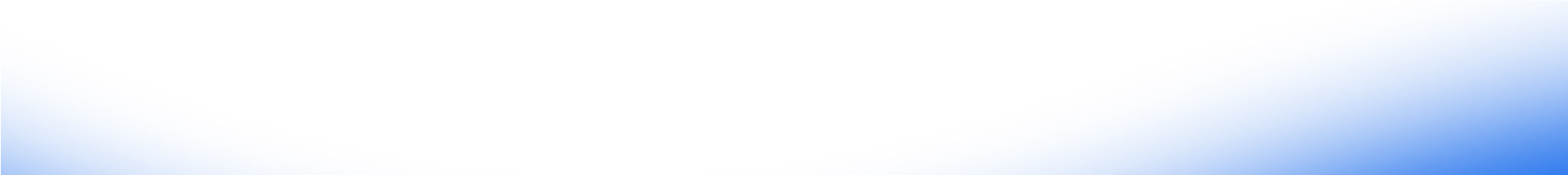

Benefits of SKU Rationalisation for UK Retailers

Implementing a structured SKU rationalisation process delivers measurable operational and financial improvements. For UK retailers operating in competitive and cost-sensitive markets, the benefits go beyond simply reducing product count.

1. Improved Cash Flow

One of the biggest advantages of SKU rationalisation is the release of working capital. By removing slow-moving or low-margin products, retailers reduce the amount of money tied up in stagnant inventory. This allows capital to be reinvested into high-performing SKUs or growth initiatives.

2. Lower Storage and Fulfilment Costs

Excess inventory increases warehouse space requirements and handling complexity. Through effective SKU optimisation UK practices, businesses can reduce holding costs and improve warehouse efficiency. A leaner catalogue directly supports better multi-channel inventory management.

3. Better Inventory Turnover

Focusing on high-demand products improves sales velocity and turnover rates. Faster inventory movement reduces the risk of stock obsolescence and write-offs, strengthening overall profitability.

4. Stronger SKU Performance Analysis

With fewer underperforming items clouding the data, retailers gain clearer insights from SKU performance analysis. This makes forecasting more accurate and improves demand planning across channels.

5. Simplified Multi-Channel Operations

For businesses selling across marketplaces such as Amazon and eBay, a streamlined product catalogue reduces duplication, reporting errors, and stock inconsistencies. Centralised inventory reporting becomes more reliable when unnecessary complexity is removed.

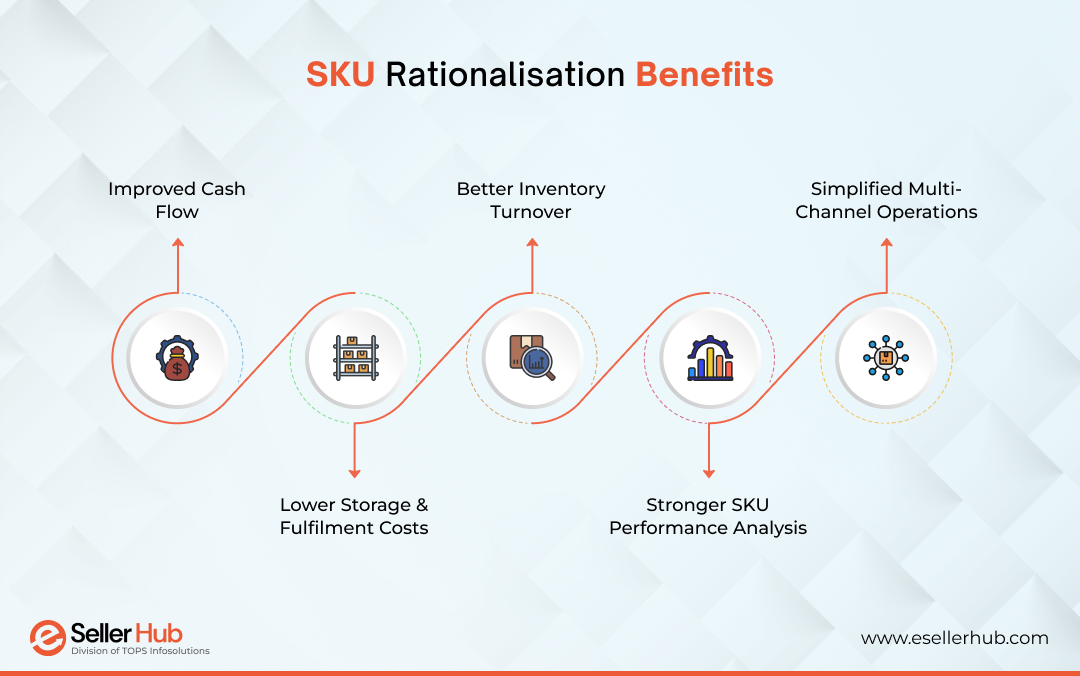

Why SKU Proliferation is a Growing Challenge for UK Retailers

As UK retail becomes increasingly competitive, expanding product ranges can seem like a natural growth strategy. However, uncontrolled SKU proliferation often creates more operational pressure than advantage. For retailers operating in a multi-channel environment, the risks are amplified.

-

Multi-Channel Selling Complexity

Selling across platforms introduces additional layers of management. Duplicate listings, fragmented performance data, and inconsistent stock synchronisation can make it difficult to maintain accurate inventory records. When SKUs multiply across marketplaces such as Amazon and eBay, visibility becomes harder to maintain.

-

Rising Warehousing Costs in the UK

Warehouse space in the UK is increasingly expensive. Holding excess or slow-moving inventory increases storage costs and reduces available capacity for fast-selling products. Over time, this directly impacts profit margins.

-

Compliance and VAT Reporting Pressure

More SKUs mean more transactions, more stock movements, and more reporting complexity. Managing VAT calculations, reconciliations, and compliance requirements becomes more demanding as product catalogues grow.

-

Supply Chain Volatility

Uncertain demand patterns and supplier variability increase the risk of overstocking. When retailers carry too many SKUs, forecasting becomes more complicated and inventory risk rises.

Without disciplined SKU optimisation, catalogue expansion can quickly shift from growth driver to operational burden.

Signs Your Business Needs SKU Rationalisation

Many retailers do not recognise the impact of SKU proliferation until costs begin to rise or margins start to shrink. If your catalogue has expanded steadily over time, it may be worth reviewing whether every product still earns its place.

Use the checklist below to assess whether your business could benefit from a structured SKU rationalisation process.

The SKU Health Checklist

If several of the following apply to your business, it may be time to begin a structured SKU optimisation UK review.

- Revenue concentration: A small percentage of SKUs generate the majority of total revenue.

- Stagnant stock: Dead or obsolete inventory has been sitting in storage for more than six months.

- Aggressive discounting: Frequent markdowns or stock write-offs are required to clear slow-moving products.

- Rising overheads: Warehouse and storage costs are increasing without proportional sales growth.

- Slow marketplace movement: Inventory moves slowly across marketplaces such as Amazon and eBay UK.

- Operational strain: Maintaining accurate multi-channel inventory management is becoming increasingly difficult.

- Forecasting gaps: You regularly overstock weak performers while running out of bestsellers.

- Internal SKU competition: Similar or overlapping product variations compete against each other instead of driving incremental growth.

If you identify multiple warning signs, conducting a detailed SKU performance analysis should be a priority.

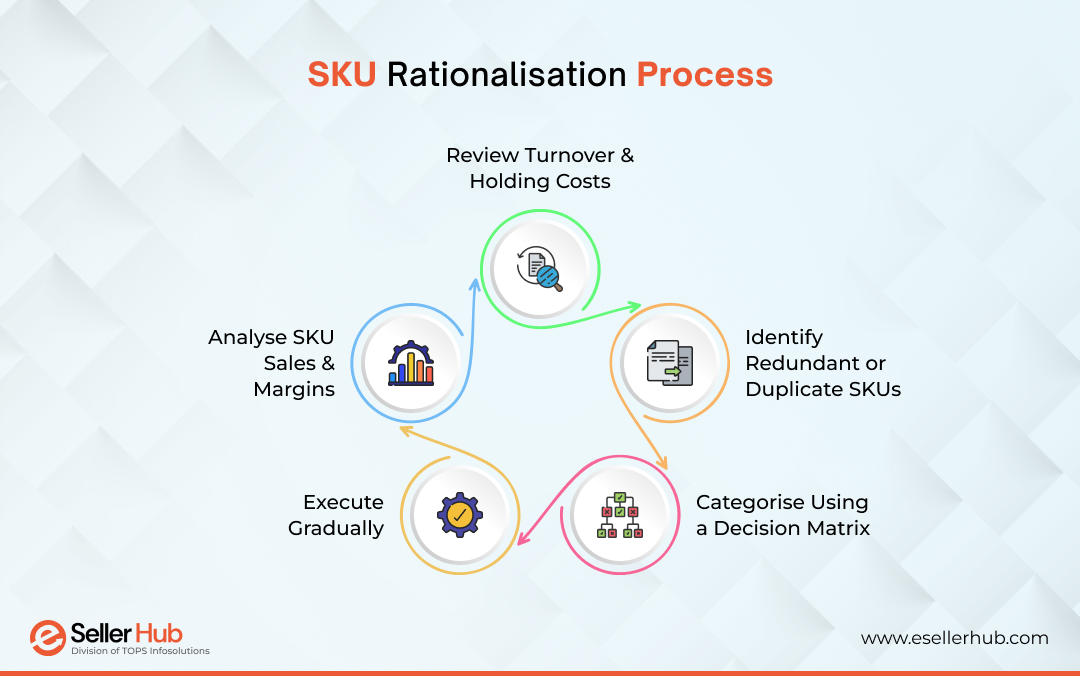

Step-by-Step Process for Effective SKU Rationalisation

An effective SKU rationalisation process should be structured and data-driven. Rather than making reactive cuts, retailers should evaluate performance carefully and implement changes in a controlled manner.

Step 1: Analyse Sales and Margin Performance by SKU

Start by reviewing each SKU’s revenue, gross margin, and contribution margin. High revenue does not always mean high profitability. Focus on identifying products that consistently deliver strong financial returns versus those that consume resources without meaningful contribution.

Step 2: Review Inventory Turnover and Holding Costs

Examine how quickly each SKU moves through your inventory. Days on hand and carrying cost per SKU are critical indicators. Slow turnover often signals excess stock, increasing storage costs and tying up working capital.

Step 3: Identify Redundant, Low-Value or Duplicate SKUs

Over time, product variations may overlap or compete with each other. Review listings across marketplaces such as Amazon and eBay UK to identify duplicate or low-demand items that add complexity without increasing revenue.

Step 4: Categorise SKUs Using a Decision Matrix

Group products into a clear framework to determine their future direction:

- Keep: High-performing and profitable core products

- Improve: Slow movers with potential, which may benefit from better listings, pricing, or optimisation

- Bundle: Lower-margin items that create greater value when combined

- Discontinue: Products that drain cash and warehouse space without delivering adequate return

Step 5: Plan and Execute Gradually

Avoid sudden large-scale removals. Align warehouse stock levels, marketplace listings, pricing strategies, and forecasting before discontinuing products. A phased approach protects operational stability and ensures multi-channel inventory management remains accurate during the transition.

Common Mistakes to Avoid During SKU Rationalisation

Even with a structured SKU rationalisation process, retailers can make costly errors if decisions are rushed or based on incomplete data. To ensure your catalogue remains profitable while protecting valuable products, avoid these common pitfalls.

1. Cutting SKUs Based Only on Revenue

Relying solely on top-line revenue can be misleading. Some low-revenue SKUs may deliver strong margins, act as entry-level products for your brand, or support the sales of high-performing items.

2. Ignoring Seasonal Demand

Certain SKUs perform well only during specific seasons or promotional cycles. Removing a product because it performed poorly in one month can result in lost revenue during peak periods. Always review historical data across a full 12-month cycle before making decisions.

3. Overlooking Channel Performance Differences

A product may underperform on Amazon UK while remaining a consistent seller on eBay UK or your direct store. Conduct SKU performance analysis separately for each platform before discontinuing any product.

4. Misalignment Between Inventory and Listings

Removing physical inventory without updating digital listings creates operational issues such as overselling and negative marketplace feedback. Multi-channel inventory management must remain synchronised throughout the rationalisation process.

5. Rushing the Rationalisation Process

Making large-scale changes too quickly can disrupt cash flow and forecasting accuracy. A phased and data-driven approach ensures smoother SKU optimisation UK execution while maintaining operational stability.

The Role of Accurate Inventory and Order Visibility

Effective SKU rationalisation depends on accurate and consolidated data. When sales performance, inventory levels, and margin reports are scattered across different systems, retailers risk making decisions based on incomplete information. Fragmented data can lead to discontinuing profitable SKUs or keeping underperforming products longer than necessary.

For retailers operating across multiple channels such as Amazon and eBay UK, consistent stock synchronisation and centralised reporting are essential. A warehouse management system helps centralise stock data, track SKU movement in real time, and support accurate decision-making during the rationalisation process.

A unified view of inventory and order performance enables clearer SKU performance analysis and supports smarter, data-driven SKU optimisation UK decisions. Without reliable visibility, rationalisation becomes guesswork rather than strategy.

Conclusion

SKU rationalisation is not a one-off project. It is an ongoing discipline for UK retailers seeking to protect margins in an increasingly expensive market. By removing unnecessary complexity from your catalogue, you release capital, reduce warehouse pressure, and create space to scale your most profitable product lines.

Success in today’s multi-channel retail environment requires more than spreadsheets alone. It demands accurate data, centralised visibility, and a structured SKU rationalisation process. With the right approach, inventory shifts from being a cost burden to becoming a strategic asset that strengthens profitability and long-term growth.